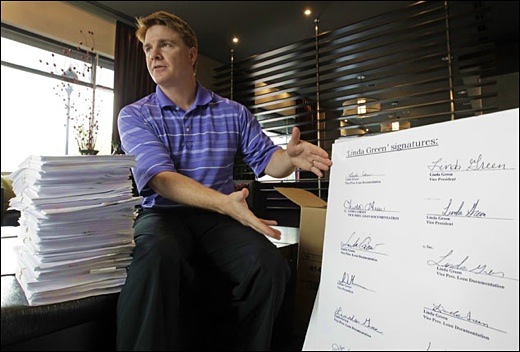

Image above: Registrar Jeff Thigpen of Guilford County, N.C., shows a group of signatures on loan documents all "signed" by Linda Green. From (http://dailyreporter.com/2011/07/19/report-mortgage-robo-signing-goes-on/).

An audit by San Francisco county officials of about 400 recent foreclosures there determined that almost all involved either legal violations or suspicious documentation, according to a report released Wednesday.

Anecdotal evidence indicating foreclosure abuse has been plentiful since the mortgage boom turned to bust in 2008. But the detailed and comprehensive nature of the San Francisco findings suggest how pervasive foreclosure irregularities may be across the nation.

Image above: Registrar Jeff Thigpen of Guilford County, N.C., shows a group of signatures on loan documents all "signed" by Linda Green. From (http://dailyreporter.com/2011/07/19/report-mortgage-robo-signing-goes-on/).

An audit by San Francisco county officials of about 400 recent foreclosures there determined that almost all involved either legal violations or suspicious documentation, according to a report released Wednesday.

Anecdotal evidence indicating foreclosure abuse has been plentiful since the mortgage boom turned to bust in 2008. But the detailed and comprehensive nature of the San Francisco findings suggest how pervasive foreclosure irregularities may be across the nation. The improprieties range from the basic — a failure to warn borrowers that they were in default on their loans as required by law — to the arcane. For example, transfers of many loans in the foreclosure files were made by entities that had no right to assign them and institutions took back properties in auctions even though they had not proved ownership.

Commissioned by Phil Ting, the San Francisco assessor-recorder, the report examined files of properties subject to foreclosure sales in the county from January 2009 to November 2011. About 84 percent of the files contained what appear to be clear violations of law, it said, and fully two-thirds had at least four violations or irregularities.

Kathleen Engel, a professor at Suffolk University Law School in Boston said: “If there were any lingering doubts about whether the problems with loan documents in foreclosures were isolated, this study puts the question to rest.”

The report comes just days after the $26 billion settlement over foreclosure improprieties between five major banks and 49 state attorneys general, including California’s. Among other things, that settlement requires participating banks to reduce mortgage amounts outstanding on a wide array of loans and provide $1.5 billion in reparations for borrowers who were improperly removed from their homes.

But the precise terms of the states’ deal have not yet been disclosed. As the San Francisco analysis points out, “the settlement does not resolve most of the issues this report identifies nor immunizes lenders and servicers from a host of potential liabilities.” For example, it is a felony to knowingly file false documents with any public office in California.

In an interview late Tuesday, Mr. Ting said he would forward his findings and foreclosure files to the attorney general’s office and to local law enforcement officials. Kamala D. Harris, the California attorney general, announced a joint investigation into foreclosure abuses last December with the Nevada attorney general, Catherine Cortez Masto. The joint investigation spans both civil and criminal matters.

The depth of the problem raises questions about whether at least some foreclosures should be considered void, Mr. Ting said. “We’re not saying that every consumer should not have been foreclosed on or every lender is a bad actor, but there are significant and troubling issues,” he said.

California has been among the states hurt the most by the mortgage crisis. Because its laws, like those of 29 other states, do not require a judge to oversee foreclosures, the conduct of banks in the process is rarely scrutinized. Mr. Ting said his report was the first rigorous analysis of foreclosure improprieties in California and that it cast doubt on the validity of almost every foreclosure it examined.

“Clearly, we need to set up a process where lenders are following every part of the law,” Mr. Ting said in the interview. “It is very apparent that the system is broken from many different vantage points.”

The report, which was compiled by Aequitas Compliance Solutions, a mortgage regulatory compliance firm, did not identify specific banks involved in the irregularities. But among the legal violations uncovered in the analysis were cases where the loan servicer did not provide borrowers with a notice of default before beginning the eviction process; 8 percent of the audited foreclosures had that basic defect.

In a significant number of cases — 85 percent — documents recording the transfer of a defaulted property to a new trustee were not filed properly or on time, the report found. And in 45 percent of the foreclosures, properties were sold at auction to entities improperly claiming to be the beneficiary of the deeds of trust. In other words, the report said, “a ‘stranger’ to the deed of trust,” gained ownership of the property; as a result, the sale may be invalid, it said.

In 6 percent of cases, the same deed of trust to a property was assigned to two or more different entities, raising questions about which of them actually had the right to foreclose. Many of the foreclosures that were scrutinized showed gaps in the chain of title, the report said, indicating that written transfers from the original owner to the entity currently claiming to own the deed of trust have disappeared.

Banks involved in buying and selling foreclosed properties appear to be aware of potential problems if gaps in the chain of title cloud a subsequent buyer’s ownership of the home. Lou Pizante, a partner at Aequitas who worked on the audit, pointed to documents that banks now require buyers to sign holding the institution harmless if questions arise about the validity of the foreclosure sale.

The audit also raises serious questions about the accuracy of information recorded in the Mortgage Electronic Registry System, or MERS, which was set up in 1995 by Fannie Mae and Freddie Mac and major lenders. The report found that 58 percent of loans listed in the MERS database showed different owners than were reflected in other public documents like those filed with the county recorder’s office.

The report contradicted the contentions of many banks that foreclosure improprieties did little harm because the borrowers were behind on their mortgages and should have been evicted anyway. “We can deduce from the public evidence,” the report noted, “that there are indeed legitimate victims in the mortgage crisis. Whether these homeowners are systematically being deprived of legal safeguards and due process rights is an important question.”

The Joke is on Us SUBHEAD: If you own a gun, you can rob a bank — but if you own a bank, you can rob the entire world. By Brian J. O'Conner on 13 February 2012 for the Detroit News - (http://www.detroitnews.com/article/20120213/OPINION03/202130311/Foreclosure-deal-joke-us)

The recently announced $25billion nationwide settlement on illegal foreclosures reminds me of a joke my dad used to tell:

A robber is hauled before a judge, who finds the evidence skimpy. "Not guilty!" the judge declares. "Terrific!" the robber exclaims to his lawyer. "Does this mean I get to keep the money?"

I'm betting that after the foreclosure deal was announced Thursday, that same sentiment echoed throughout the big banks, hedge funds, mortgage processors and all the others who bred the busted mortgage bubble that produced the worst worldwide financial crisis since the Great Depression. Because, if they're OK coughing up $25billion, they must be hanging on to much, much more.

Case in point

If you doubt me, consider another government settlement over ongoing, wholesale fraud perpetrated by a company that, interestingly, is one of the five big banks involved in the foreclosure deal. Earlier this month, a court filing by JPMorgan Chase & Co. revealed the mega-bank will pay $110 million to settle claims it unfairly inflated overdraft fees on customers. The case included one example of the bank posting a $1,725 automatic bill payment five days early, which generated $231 in extra overdraft fees.

I've written about the scourge of banks defrauding their own customers by tweaking procedures to increase overdrafts. But it's a profitable scourge — even if you get caught. As American Banker reports, Chase itself said it made $500 million a year after taxes by rigging customer accounts with added overdrafts.

Let's do the math: Steal $500million a year for several years, minus $110 million one-time penalty = a pretty good deal. But it doesn't equal justice.

A joke on consumers

So, just as in my dad's joke, the robbers get to keep the money, minus a small service charge. But there's another joke here, and it's being played on consumers, workers, homeowners, students and anyone else who's been paying the price for bankers' financial misconduct for years already and will continue paying it for many more to come.

It's business as usual for the banks, though, and a profitable one. Consider that JPMorgan has received 22 waivers from the Securities and Exchange Commission allowing it to avoid penalties in fraud cases, including one recent case that involved a $228million settlement.

Getting back to my dad's original gag, I'd say the real humor in the punch line isn't the robber's lack of discretion, but his lack of ambition. Because, if you own a gun, you can rob a bank — but if you own a bank, you can rob the entire world.

.

No comments :

Post a Comment